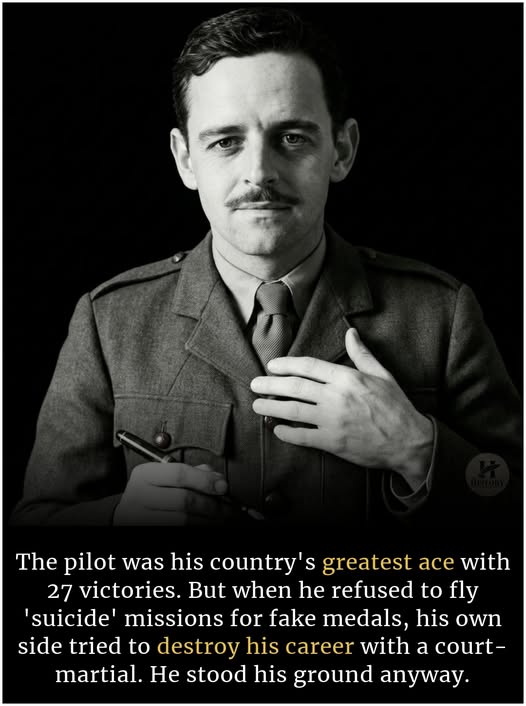

Clive Caldwell didn’t look like a man who would become a legend when he joined the RAAF in 1939. He was already nearly 30 years old, considered an ’old man’ by the standards of fighter pilots. But nature had gifted him with eyes like a hawk and nerves of pure steel.

In the burning sands of North Africa, he proved his worth in 1941. During a single afternoon, he did the impossible. He intercepted a massive formation of German dive bombers and snatched five victories from the sky in minutes.

He became an ’Ace in a Day’ and earned the nickname ’Killer’ for his lethal efficiency. He saw the fire. He saw the smoke. He saw the high price of freedom.

But as the war shifted to the Pacific, the nature of the fight changed. Clive Caldwell was now a commander, responsible for the lives of young men who looked to him for guidance. He was a leader who actually cared for his flock.

By 1945, the high command was ordering his pilots on ’milk runs’ against isolated Japanese outposts. These missions had no strategic value. They were suicide runs designed to pad the resumes of desk-bound generals.

Caldwell saw the waste. He saw the arrogance. He saw the unnecessary empty chairs at the mess hall. He decided he had seen enough.

In a move that shocked the military world, he and seven other pilots turned in their resignations. It was called the ’Morotai Mutiny.’ It wasn’t an act of cowardice, but an act of extreme moral courage against a corrupt bureaucracy.

He refused to trade his men’s blood for a general’s promotion. The military brass was humiliated. They couldn’t court-martial him for wanting to save lives, so they looked for another way to tear him down.

They found their opening in a ’liquor trading’ scandal. It was a common practice among troops, but they used it to hammer the man who dared to defy them. They stripped him of his rank and tried to bury his legacy in shame.

But you cannot bury the truth. An official inquiry later vindicated the pilots and removed the generals responsible for the waste. He left the service with his head held high and his soul intact.

He went on to become a successful businessman, proving that a man of character can thrive anywhere. He was Australia’s greatest ace, but his finest victory was standing up for what was right. Character is what you do when the world is against you.

Sources: National Archives of Australia / Australian War Memorial

The legendary Clive Caldwell lived to be 83 years old, passing away in 1994. In his later years, he rarely spoke of his personal kills or the medals he won. Instead, he took the most pride in the fact that he stood up for his men when it mattered most.

He once remarked that his court-martial was a small price to pay for his integrity. Even after being reduced in rank, he never showed bitterness toward the country he served. He understood that sometimes the ’swamp’ in the rear is more dangerous than the enemy in the air.

He shifted his focus to help build Australia’s post-war economy through his import-export business. He remained a figure of quiet strength until the very end, buried with the respect of a nation that eventually recognized his sacrifice.