From an International Man Communique newsletter.

The relationship between energy consumption and national wealth is one of history’s most consistent patterns.

From coal-fired Britain to oil-powered America to today’s renewable energy leaders, access to abundant, affordable energy has been the foundation of economic prosperity. This correlation isn’t coincidental — it’s mechanical. Energy powers industry, transportation, communication, and virtually every productive activity that generates wealth.

The Industrial Revolution provides history’s clearest demonstration. Britain’s dominance in the 18th and 19th centuries directly correlated with its exploitation of coal reserves. Coal powered steam engines, which mechanized textile production, iron smelting, and transportation. Britain’s GDP per capita increased roughly 10-fold between 1750 and 1900, precisely tracking its exponential increase in coal consumption.

Nations without coal access — or unwilling to industrialize — remained agrarian and poor. The energy-wealth gap widened dramatically during this period, creating the modern developed-developing world divide. As an aside, this is how a nation with crooked teeth and zero cuisine could go about bullying and colonizing much of the world.

America’s ascent to superpower status followed an identical pattern, but with oil instead of coal. The discovery of Pennsylvania oil in 1859, followed by massive Texas fields in the early 1900s, gave America an unprecedented energy advantage. Cheap, abundant petroleum powered automobiles, aviation, petrochemicals, and eventually plastics — entire industries that wouldn’t exist without energy density only oil provides.

By 1950, America consumed half the world’s energy and produced half its GDP. This wasn’t correlation; it was causation. Energy powered the factories, transported the goods, and literally fueled American prosperity.

Post-war Japan and Germany demonstrated how energy access drives reconstruction. Both nations were devastated in 1945, yet rebuilt rapidly by securing reliable energy supplies. Germany imported coal and developed nuclear power. Japan, lacking domestic energy, built the world’s most efficient industrial base to maximize limited resources. Both became economic powerhouses not despite energy constraints but by prioritizing energy infrastructure. In fact, this is why supply chains matter. In any event, their GDP growth rates directly tracked energy consumption increases through the 1960s-80s.

The correlation holds in reverse, too…

The 1970s oil shocks proved that energy scarcity creates immediate economic contraction. When OPEC embargoed oil shipments, Western economies plunged into recession. GDP growth rates turned negative precisely when energy supplies tightened and prices spiked. The lesson was unmistakable: modern economies simply cannot function without abundant energy. Prosperity requires power, literally.

China’s recent transformation provides the most dramatic modern example.

Between 1980 and 2020, China’s energy consumption increased 20-fold while GDP grew 50-fold. China went from producing 2% of global GDP to 18% by becoming the world’s largest energy consumer. They built coal plants at unprecedented rates, imported massive oil and gas quantities, and invested heavily in renewables.

Energy access didn’t just correlate with growth — it enabled it. You cannot manufacture steel, operate factories, or power cities without energy. China’s wealth came from energy-powered industrialization.

Today’s correlation remains unchanged. The wealthiest nations — America, Germany, Japan, South Korea — consume vastly more energy per capita than poor nations. Sub-Saharan Africa, with minimal electricity access, remains poor not coincidentally but consequently. Energy poverty is economic poverty.

The pattern is mathematical: energy powers machines, machines amplify human productivity, productivity creates wealth. No nation has ever developed without dramatically increasing energy consumption.

The energy-wealth correlation isn’t just historical observation — it’s economic law. Prosperity requires power, and those who control abundant, affordable energy will dominate economically. It’s always been that way, and it likely always will be.

Editor’s Note: The historical pattern laid out above is unmistakable: energy is the foundation of wealth, and shifts in energy access signal much larger economic realignments.

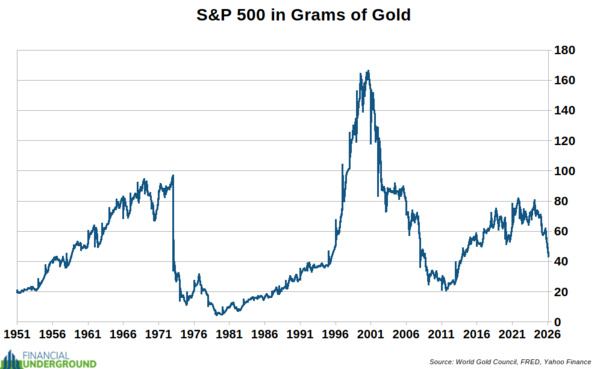

As the global system moves into a period of tighter resources, rising geopolitical tension, and structural strain, the consequences will be felt first in markets and capital flows.