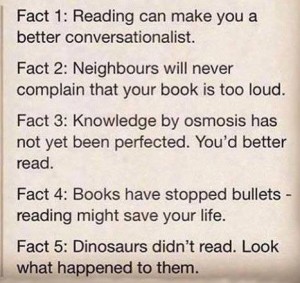

5 Reasons To Read

Three Sisters

Three sisters age 92, 94 and 96 live in a house together.

One night the 96 year old draws a bath, puts her foot in and pauses.

She yells down the stairs, “Was I getting in or out of the bath?”

The 94 year old yells back, “I don’t know, I’ll come up and see.”

She starts up the stairs and pauses, then she yells,

“Was I going up the stairs or coming down?”

The 92 year old was sitting at the kitchen table having tea

listening to her sisters. She shakes her head and says,

“I sure hope I never get that forgetful.” She knocks

on wood for good measure. She then yells,

“I’ll come up and help both of you as soon as I see

who’s at the door.”

Caffeine may boost long-term memory

Here are some interesting pros and cons to caffeine consumption.

http://www.medicalnewstoday.com/articles/270963.php

In Vaccines We Trust?

One excerpt: The hepatitis A vaccine was the placebo for the influenza vaccine in a well publicized study. The study’s designer is quoted as saying that he didn’t want to withhold a potentially beneficial treatment from the control subjects. “Hepatitis was not studied, but to keep the investigators from knowing which colonies received flu vaccine, they had to offer placebo shots, and hepatitis shots do some good while sterile water injections do not.” So, if the placebo is supposed to have no therapeutic effect as the definition that was taken from an ardently pro-vaccine website that criticizes our criticism of their use of placebos, and the study used hepA placebo because “water does no good” … where on earth is the match up with even their definition of science?

http://www.greenmedinfo.com/blog/vaccines-we-trust

Never Miss An Opportunity

If you haven’t already answered this question, I recommend you stop and look at your options for a minute.

What are you planning to do today to make this weekend AWESOME for you and someone else?

I reread this and thought, “It also pays to be an opportunist – to take advantage of the moment to help when it presents itself. Often unplanned opportunities to help manifest that, if you take advantage of them, can result in a much greater gain than you might at first imagine.”

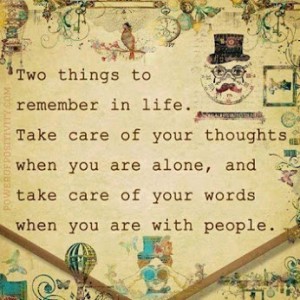

Two Things To Remember

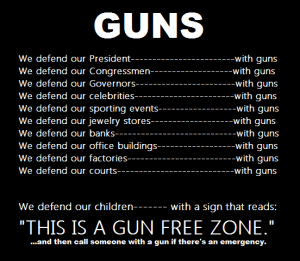

Gun Illogic

Dealing with stepchildren in super

By Julie Steed, Technical Services Manager

An issue that arises in blended families is in relation to stepchildren. Stepchildren are included in the definition of a child, however the step-parent/child relationship is severed upon the dissolution of the natural parent’s relationship with the step-parent. This often happens as a result of divorce or death.

The severed relationship between step-parent and children has long been a principal in family law and was recently confirmed as the case for superannuation death benefits in ATO ID 2011/77. The Superannuation Complaints Tribunal (SCT) has also used this principal in deciding cases.1

This means that the step-parent is unable to leave their superannuation benefits to their stepchildren since they no longer will meet the definition of a child. The children may however still qualify under financial dependency or interdependency.

An alternative is for the step-parent to formally adopt the stepchildren. If this occurs, the stepchild becomes a legally adopted child, who then has all of the legal rights and entitlements of a natural child. However, in practice this formality is rarely undertaken. It is particularly difficult in the event of a second marriage where the natural parent will generally object to their child being adopted by another person. It is more likely where one of the natural parents has died and the surviving parent remarries, although it is still uncommon.

Where there are blended families, the interaction between superannuation death benefits and careful estate planning becomes all the more important in order to ensure that the family’s wishes are able to be fulfilled.

Case study

Andy and Jill married many years ago and each have two children from previous marriages, Mandy and Candy and Bill and Phil. Andy and his first wife had an acrimonious divorce. Jill’s first husband died shortly before the birth of Phil.

estate affairs

Andy and Jill have made life long commitments to each other and to each other’s children. It is Andy and Jill’s wish that if one of them dies, the other inherits everything but on the death of the second of them, all assets are divided equally between their four children.

Andy and Jill visit their financial planner who runs through the different scenarios, before calling in an estate planning specialist.

Andy and Jill have the following assets:

Ownership Asset Value

Joint Family home $600,000

Joint Shares $150,000

Joint Cash $50,000

Andy Superannuation $200,000

Jill Superannuation $30,000

Jill Death benefit pension from Jack $600,000

Total $1,630,000

What would happen if they both passed away now?

Assume Andy and Jill were both involved in a serious car accident. Jill died at the scene and Andy died in hospital six weeks later. If they both died without a Will and without superannuation death benefit nominations, the following is the best outcome that could be obtained.2

As Jill died first, her share of the jointly held assets will generally pass to Andy due to the right of survivorship. Upon Andy’s death, all of the jointly held assets will pass to his children. Andy’s superannuation could pass 50 per cent to each of his children ($100,000 each) but none could pass to Bill and Phil as the death of Jill has severed the step-parent/child relationship.

The only way Bill and Phil could receive any of the superannuation benefit is if they were financially dependent or in an interdependency relationship with Andy. The same applies to Andy’s children in respect of Jill’s superannuation and this means her superannuation will be shared equally between her children. Assuming that the children were not living at home and not dependent, the distribution would be as follows:

Child Amount received 3 Calculation

Mandy $500,000 ($600,000 + $150,000 + $50,000 + $200,000) divided by 2

Candy $500,000 ($600,000 + $150,000 + $50,000 + $200,000) divided by 2

Bill $315,000 ($600,000 + $30,000) divided by 2

Phil $315,000 ($600,000 + $30,000) divided by 2

Total $1,630,000

What if some of the children were financially independent?

The situation is further complicated if one of the stepchildren was financially dependent and the other was not.

Consider the scenario where Candy was the only child living with Andy and Jill. Candy would qualify as being in an interdependency relationship with Jill and although the step-parent/child relationship is severed, Candy is eligible to receive one third of Jill’s superannuation.

Child Amount received3 Calculation

Mandy $500,000 ($600,000 + $150,000 + $50,000 + $200,000) divided by 2

Candy $710,000 ($600,000 + $150,000 + $50,000 + $200,000) divided by 2 and

($600,000 + $30,000) divided by 3

Bill $210,000 ($600,000 + $30,000) divided by 3

Phil $210,000 ($600,000 + $30,000) divided by 3

Total $1,630,000

Even if Andy and Jill had death benefit nominations in place to request 25 per cent to each of the four children, the superannuation fund trustees would be unable to make payments to the stepchildren of Andy and Jill since that relationship is severed upon their death. The stepchildren could only qualify if they were financially dependent or in an interdependency relationship.

Andy and Jill’s adviser calls in an estate planning specialist who structures their affairs to ensure that their wishes are met in the most efficient and tax-effective method which will also provide protection for any children whilst they are minors.Testamentary and superannuation proceeds trusts are established via the Will and binding death benefit nominations put in place.

Conclusion

The examples above highlight how the severing of the step-parent/child relationship can result in outcomes that may differ from your client’s expectations. It is essential to update client’s estate plans, including superannuation, as family circumstances change and to utilise the services of experts who can assist with designing the desired outcomes.

1 SCT determination D04-05/186 and SCT determination D99-2000/082.

2 The intestacy laws vary in each state.

3 Before the effect of any superannuation tax has been accounted for.

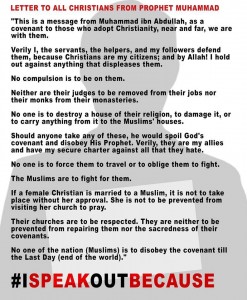

Letter To All Christians

I think this post is worth sharing.

My personal opinion is that people who kill in the name of their deity are using their deity’s name in vain.

Power seeking murderers hide behind the veil of religious righteousness because they are not courageous enough to admit their true evil intentions and know they will attract more followers by espousing a spurious cause.

Ultimate love does not demand the slaughter of innocents.

Strong people build others up.

Cowards seek to diminish the power of others and destroy them.

Only tolerance and peace will bring about tolerance and peace.

Until that is the norm, think good thoughts, speak well to and of others, do good deeds but be prepared to defend your freedoms against those who would unjustly take your property or life.